What's new

The following improvements for My Workforce Analyzer are included with the Q4 2016 (December) product updates for

Editing Last Year’s ACA Forms

With this release, we added a warning message to My Workforce Analyzer that appears when you attempt to edit forms for a prior year. This warning is to prevent you from editing forms that were previously eFiled using Sage Payroll Tax Forms and eFiling by Aatrix, as any edits to historical forms within My Workforce Analyzer cannot transfer to eFiled forms in Aatrix. To edit previously eFiled forms in Aatrix, click the button.

Form 1094-C Updates for 2016

The IRS released updates for the 1094-C (Transmittal of Employer Provided Health Insurance Offer and Coverage Information Returns) for 2016, and the system was updated to include the changes. More...

Form 1095-C Updates for 2016

The IRS released updates for the 1095-C (Employer Provided Health Insurance Offer and Coverage) for 2016. The system was updated to include the changes. More...

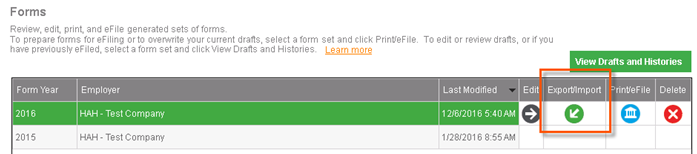

Export and Import Feature to Support Mass Form Changes

With this release we added new functionality to support mass updates to ACA forms. You can use the Export and Import feature, a button on the My Workforce Analyzer > Forms (tab) > Forms panel, to edit Part II and Part III information in the generated form sets.

Use the function to create a .CSV file with all of the information (1095-C Part II Employee Offer and Coverage information, or Part III Covered Individuals) currently in the forms. Next, use Microsoft Excel, for example, to edit the information (for all employees or groups of employees) at once in a spreadsheet. Finally, use the function to pull the updated information in to the forms set. View...

Tip: See Reviewing, printing, and filing forms in help for instructions and more information about using Export and Import.

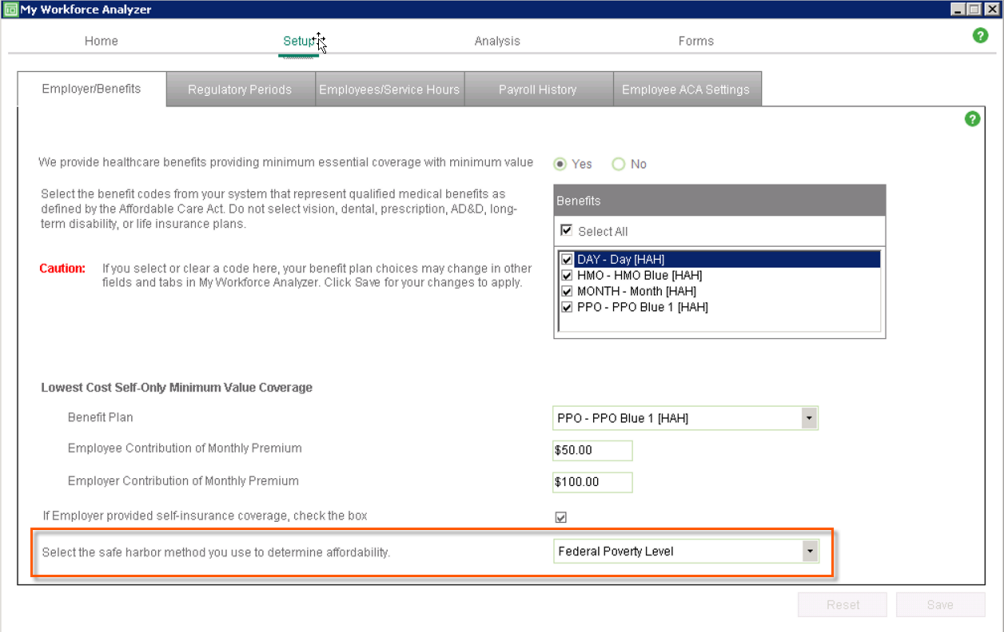

Safe Harbor Maximum Contribution Percentage Change

The Internal Revenue Service issued Revenue Procedure 2016-24 to index the contribution percentages in 2017 for purposes of determining the affordability of an employer’s plan under the Affordable Care Act. My Workforce Analyzer has been updated to calculate affordability with the percentage appropriate for each year.

The maximum contribution percentage was 9.56% in 2015, and 9.66% in 2016. For plan years beginning in 2017, employer-sponsored coverage will be considered affordable if the employee’s required contribution for self-only coverage does not exceed 9.69% of the employee’s household income for the year, for purposes of both the pay or play rules and premium tax credit eligibility.

Tip: For more information about maximum contributions, see the help glossary.

Employment Status Menus

We changed the name of the Employment Status drop-down menus to in two desktop windows: Setup > Employee ACA Settings (Filters), and Forms > 1095-C (Filters). We also changed the selections available in these menus. You can now use the menus to filter the information by

Form 1094-C Minimum Essential Coverage Setting

With this release, we fixed the issue where the selection on the Setup > Employer/Benefits window wasn’t updating the actual 1094-C forms. The setting, We provide healthcare benefits providing minimum essential coverage with minimum value, now correctly updates the 1094-C, Part III, Line 23 (ME coverage offered).

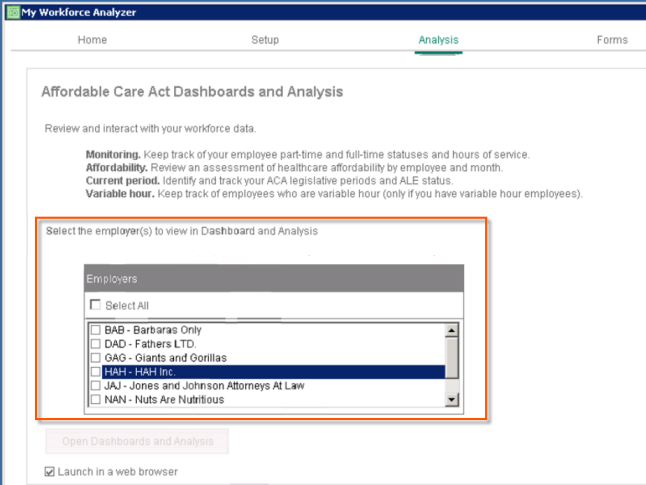

Viewing Employers in Online Dashboards and Analysis

You can now select to view one, many, or all employers in the online dashboards and analysis tools. If you select multiple employers, the system analyzes and shows the combined information. The new employer selection list is on the (desktop) My Workforce Analyzer > Analysis window. View...

Select the Safe Harbor Method Analyzed

You can now select which safe harbor method you want to view calculated in the Analysis > Affordability report. You select the method for analysis on theMy Workforce Analyzer > Setup > Employer/Benefits window. When you select different safe harbor methods here, it impacts only the Affordability report page, and it gives you the opportunity to compare what is determined affordable under each method for each employee. View...

Affordability Analysis Details

We added more detail to the Analysis > Affordability report so you can see how each safe harbor method compares the cost of your company’s lowest employee-only (minimum value) healthcare plan for each employee. We also changed the calculations so they no longer predict affordability for future dates or time frames for which there is no payroll history.

To view the affordability details, click on any employee row on the Affordability page and that employee’s detail window opens.

Tip: See Reviewing affordability information in help for more information about the affordability analysis.

Click How is my workforce analyzed? at the bottom of the help topic for detailed examples of the calculations for each safe harbor method.

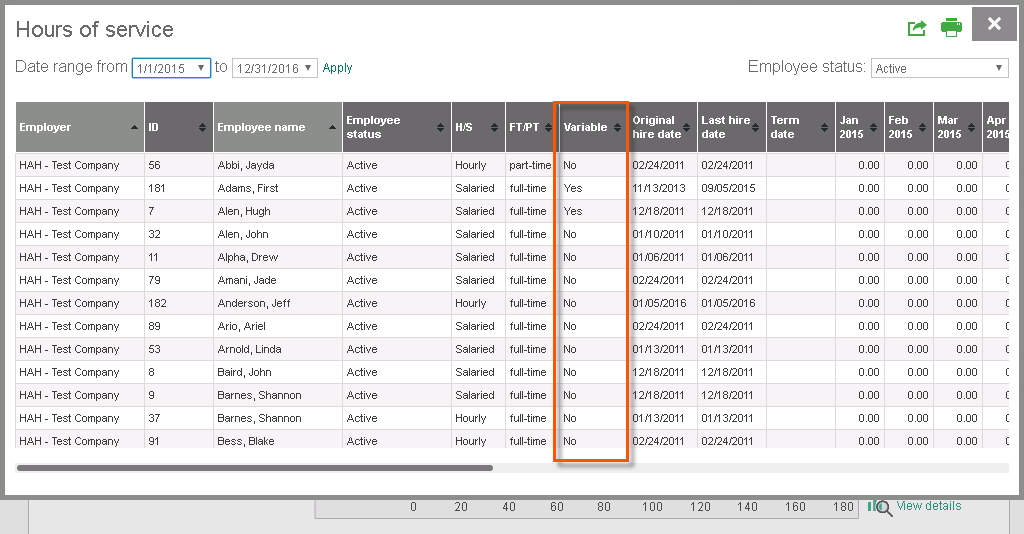

Variable Hour Employees on the Hours of Service Detail

You can now view variable hour employees on the Hours of service detail report (Analysis > Monitoring > Monitoring hours of service panel). Click the View details button at the bottom of the panel to open the Hours of service detail report, and variable hour employees are now identified under the Variable column. View...